Alberta's Pension Question

Control, Risk and the CPP Debate

The Alberta Next Panel has now done what the United Conservative Party government deliberately avoided doing itself: it has pushed the pension question into the open and recommended a referendum on withdrawing from the Canada Pension Plan.

At present, there are no formal negotiations underway with the Government of Canada. That point matters. Ottawa has been explicit: it will not negotiate withdrawal terms with Alberta unless and until Albertans vote clearly in favour of leaving the CPP. Anything else would be legally premature from a federal perspective.

The legal framework is clear, if inconvenient. Section 113 of the CPP allows a province to exit—but only after providing three years’ notice and only after reaching an agreement on asset division. Ottawa disputes Alberta’s claim to roughly 53% of CPP assets. Its position, supported by most independent actuaries outside Alberta, is that assets must be apportioned on a more conservative, contribution-and-benefits-based formula. Which means much less than 53%.

There is no backroom deal waiting to be signed. A referendum is the opening move, not the endgame. The panel understands this. The province’s critics often pretend otherwise.

The strongest case for an APP is not ideological. It is structural.

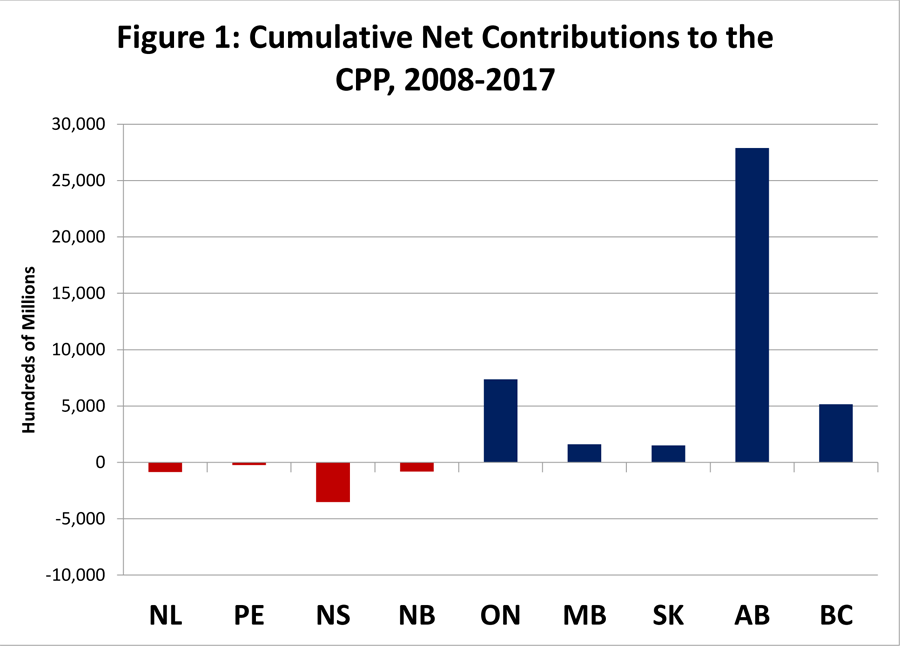

First, demographics. Alberta has a younger population, higher workforce participation, and higher average incomes than the national mean. That translates into higher per-capita contributions and lower per-capita payouts. Whether one likes it or not, Alberta subsidises older, slower-growing provinces inside the CPP. That is not a moral judgment—it is actuarial reality.

https://www.fraserinstitute.org/commentary/contributions-to-the-cpp-comparing-provinces

Second, governance and control. CPP investment decisions are made by the Canada Pension Plan Investment Board, an institution largely insulated from provincial priorities. Alberta has no meaningful say over asset allocation, domestic investment strategy, or risk tolerance.

An APP would allow Alberta to align pension investment policy with its economic strengths—energy, infrastructure, agriculture, and domestic growth—while still maintaining global diversification.

Third, cost competitiveness. Multiple studies commissioned by the province indicate that an APP could deliver either lower contribution rates or higher benefits, potentially both, assuming Alberta secures a fair share of CPP assets. Even under more conservative assumptions, Alberta contributors are unlikely to be worse off in the medium term.

Fourth, strategic optionality. A referendum on an APP is not only about pensions. It is a capability test. Can Alberta run a complex national-scale institution competently? The province already administers health care, workers’ compensation, and public-sector pensions. An APP would be a natural extension of existing administrative capacity.

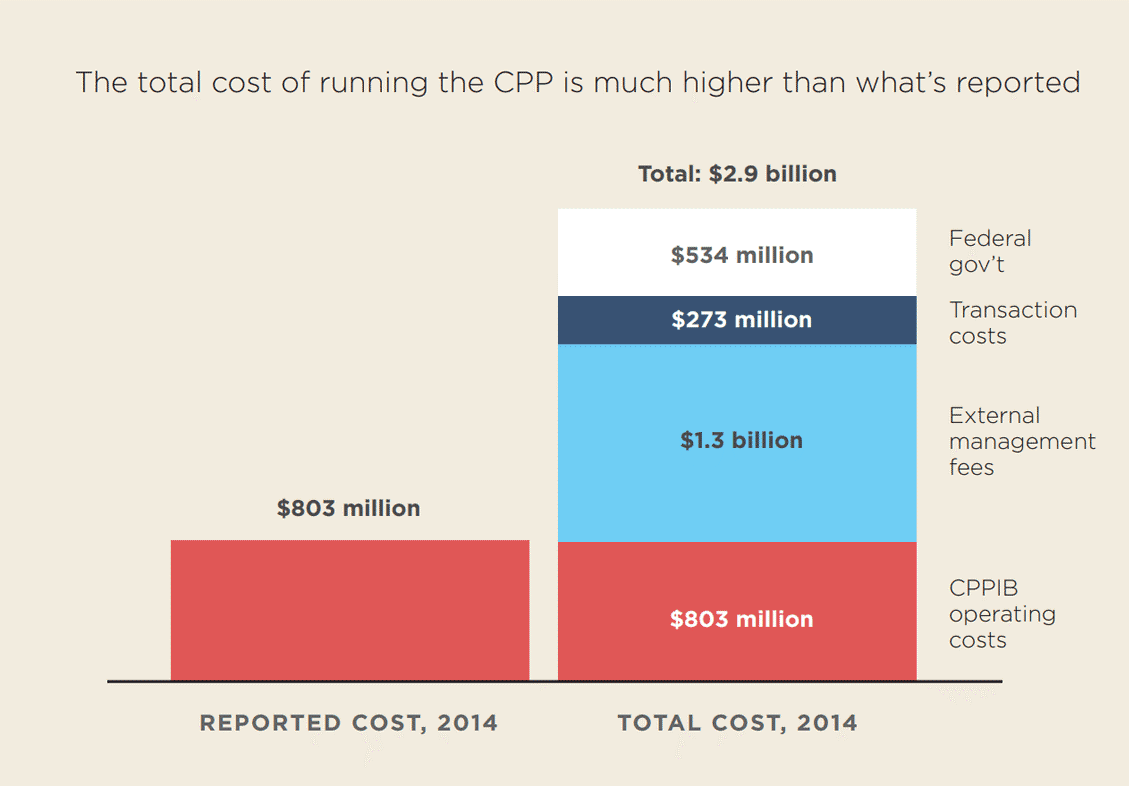

Fifth, the CPP is not a “low cost” operation.

https://www.fraserinstitute.org/myth-3-cpp-low-cost-pension-plan

But the opposition case is not frivolous, and dismissing it as fearmongering is intellectually otiose.

The first and most serious concern is transition risk. CPP is stable, mature, and globally respected. Leaving it introduces execution risk. Asset transfer disputes, startup costs, and early-year volatility could erode confidence even if long-term fundamentals remain sound. Markets punish uncertainty faster than they reward efficiency.

Second, asset division is unresolved. Alberta’s claim to more than half of CPP assets is aggressive. If Ottawa successfully forces a lower allocation, many of the promised contribution-rate advantages evaporate. Critics are right to point out that Alberta is being asked to vote without knowing the final numbers.

Third, political risk cuts both ways. Today’s Alberta government may promise arms-length governance and fiduciary discipline. Future governments may not. A provincially controlled pension fund is inherently more exposed to domestic political pressure than a national one. The temptation to “invest locally” for political optics rather than risk-adjusted returns is real.

Fourth, portability and perception. CPP is simple. Canadians understand it. Workers moving between provinces do not have to think about it. An APP introduces friction—administrative, psychological, and reputational. For professionals Alberta is trying to attract, that friction may matter at the margins.

Finally, there is trust. Many Albertans, and a vocal political opposition, simply do not trust the provincial government to manage a pension plan better than an institution that has delivered strong returns for decades. Many are also sentimentally inclined to remain with the Federal government, concerned about a significant change, regardless of the evidence.

The Alberta Next Panel has done something politically significant: it has moved the APP debate from abstract grievance to concrete choice. A referendum forces clarity.

The pro-APP case rests on demographics, economics, and institutional maturity. The anti-APP case rests on transition risk, political uncertainty, and the comfort of the status quo.

What this is not about is whether pensions will disappear or seniors will be impoverished. That rhetoric is not serious. The real question is whether Albertans believe they are better served as permanent net contributors to a national system—or as stewards of their own.

Ottawa will not decide that. The courts will not decide that. The Alberta Next Panel will not decide that.

Albertans will.

Excellent Colin, thank you. We need far more of this thoughtful writing that lays out both sides of an issue. It's sorely lacking - or hard to find, at least.

I'm a proponent of bringing the pension home. While I do see the risks of investment for political gain, I believe that cuts both ways. When we see the government playing that game, we can pressure them into behaving. When we hear Carney offer our pensions as an investment lever in the UAE, or China, we are absolutely helpless. It's also terrifying that the Liberals have it listed as an asset.

Finally, anything Quebec can do, Alberta can do just as well.

I would much prefer an Alberta pension plan over the Canadian plan, for a number of 'conspiratorial' reasons but my greatest desire is for Alberta to leave Canada and that money needs to be brought home before that happens.

I hope that when Alberta does pull the plug we stop social programs like public pensions and health care. The more money we can keep in our pockets the less need we have for those programs and the more self reliant we can be.